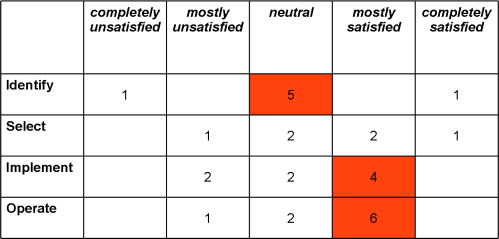

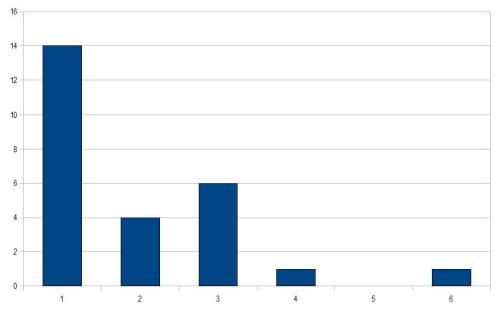

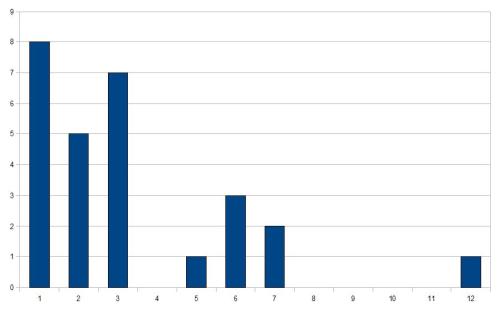

At this point in the survey, we branched out into four streams – looking separately at the processes of Identifying, Selecting, Implementing and Operating collaboration software. In each of these, we asked the question: “What was your satisfaction with the process?”

Given the spread of stages of this evolution that our respondents were engaged in, our backroom statisticians started to swoon at this point of the analysis! However, even with low numbers in each stage (N=7, 6, 8 and 9 respectively), some patterns did emerge:

It appears that those engaged in the initial stage of identification – with the exception of two extreme outliers – were fairly ambivalent. Experience was much more evenly spread in the selection stage, but it could be said that in general, the experience during implementation and operation was generally more positive. However, while there is no complete dissatisfaction after identification, there is also no complete satisfaction after selection. We will look further into some of the specific experiences in following posts.

Some general observations of important things to think about at each stage can be summarised as follows:

- Identification – Be clear on what your needs are first.

- Selection – Be clear on what your needs are first.

- Implementation – Make sure everyone is clear on what they are supposed to be doing with it now that you’ve got it.

- Operation – Realise the importance of getting all of the three key things above right the first time.